On behalf of Continental Finance, Celtic Bank has the authority to issue a Surge Credit Card Login. Celtic Bank offers all services like making Surge payments online and accessing your account online on behalf of continental Finance. Keep scrolling this page to check the complete information about Surge card login like Customer Care Number, Address, Online Registration, Surge cc Login Process, etc.

On behalf of Continental Finance, Celtic Bank has the authority to issue a Surge Credit Card Login. Celtic Bank offers all services like making Surge payments online and accessing your account online on behalf of continental Finance. Keep scrolling this page to check the complete information about Surge card login like Customer Care Number, Address, Online Registration, Surge cc Login Process, etc.

Or

On behalf of Continental Finance, Celtic Bank has the authority to issue a Surge Credit Card Login. Celtic Bank offers all services like making Surge Credit Card Payment online and accessing your account online on behalf of continental Finance. Keep scrolling this page to check the complete information about Surge card login like Customer Care Number, Address, Online Registration, Surge cc Login Process, etc.

How To Register For Surge Credit Card?

There is no complicated process to registering for a Surge Credit Card Login. You need to follow the below-stated steps to register –

- Firstly, you must visit the Continental Finance CardInfo site by filling in www.surgecardinfo.com

- You must click the “Apply Online” link and complete the online application form to register.

- To fill out the form, you should enter personal details such as name, contact details, address, etc.

- Now, press the “Continue your application” button and enter the information asked.

- Finally, click the “SUBMIT” tab or the submission of the form.

- After matching your eligibility, you will be selected for this card.

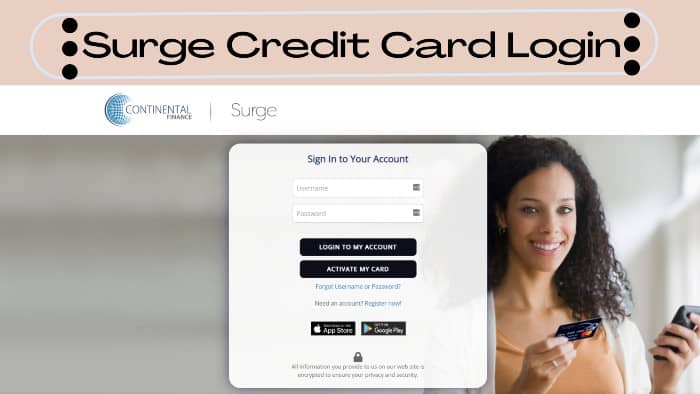

Surge Credit Card Login Steps

After the card has been mailed to you, you can create an online account to manage it and check on your card transaction. To perform Surge Credit Card Login to your online account:

- Go to the website at www.surgecardinfo.com

- Click on Manage Account

- Select your credit card (My Surge Card), and click on Go to the portal

- Click on LOGIN

- Enter your username and password

- Click on Log in

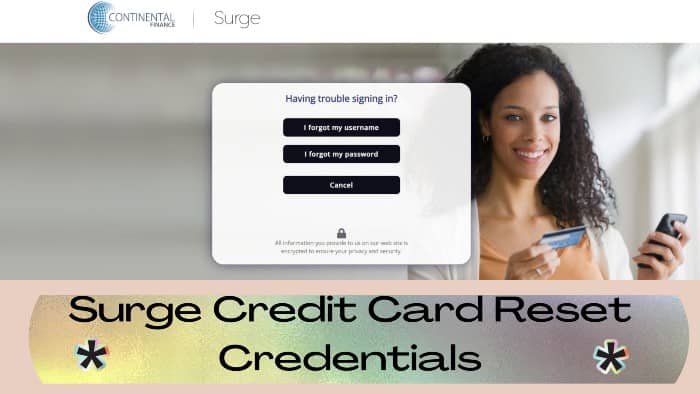

How To Recover Surge Credit Card Login Details?

It is no shock or surprise that most of us easily forget our passwords. Moreover, it is a natural thing. However, there is no need to worry. A Surge Credit Card provides a handy way to recover your login details. Here are the topmost steps on how to recover your username or password:

- Go to the webpage www.surgecardinfo.com.

- Under the Surge Card Info login button, you will see the” Forget Username or Password” button on this page.

- Click on that “Forget Username or Password” button to open up a new page. This will ask for the information regarding the card and account for verification.

- Once verified, you will get your credentials back in a few seconds.

Surge Card Online Application

The credit card application process is fast, free, and accessible. And the response is provided online instantly. Though, Continental Finance will sometimes spend more time reviewing an applicant’s credit history before sending a reply.

- Visit the website https://continentalfinance.net/.

- Click on the “Get yours now!” option from the homepage.

- Provide the required information, including name, address, city, state, zip code, email address, phone number, SSN, etc.

- Indicate whether or not you have an active checking account

- Certify that you are E.E. residents and you are over 18 years

- Agree to the terms and conditions of the credit card

- Click on Continue Application

Ensure to write down the application reference number to check your application status and whether you are approved for the card or declined.

Credit Card Account Access Online

Using the Account Access Online portal, Customers can manage recurring payments and transaction statements, get alerts, schedule payments, and manage the Surge Mastercard Login account online with ywww.surgecardinfo.com/?product=surge.

| Official Name | Surge |

|---|---|

| Country | USA |

| Language Supported | English |

| Mobile App | Available |

| Managed By | Continental Finance |

What Is Surge Mastercard?

The Surge Mastercard Login is one of the most accessible credit cards to get if you have bad credit, but its annual and monthly fees may reduce its appeal. If you’re considering the Surge Mastercard Login details to build credit, here’s what you need to know before you submit your application at www.surgecardinfo.com.

What should you know about applying?

- In order to build credit, cardholders with little or no credit history or a poor credit score should apply for a secured credit card.

- Cardholders want a chance at a higher-than-average credit limit on an unsecured credit-building card.

- Individuals without a deposit.

How to use the Surge Mastercard:

You have the best chance of improving your credit score by paying on time and keeping your credit utilization low.

To avoid potentially high APRs on the card, pay it off in full each month.

Make your first six-monthly card payments on time to get an automatic credit limit increase.

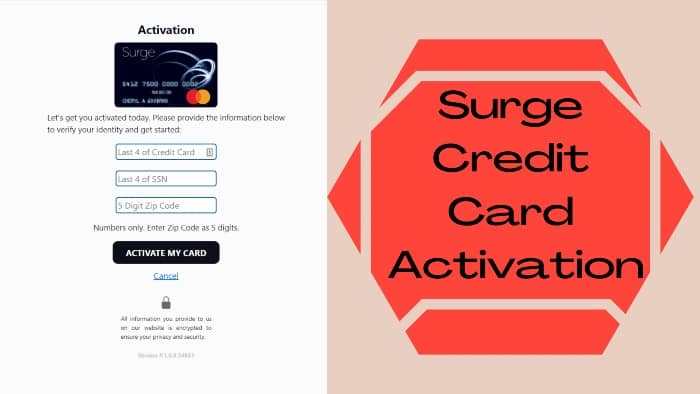

How To Activate Your Surge Card?

Activating the Surge credit card is a matter of seconds. Similarly, your card credentials are necessary for activation, and you can easily activate your Surge CC login with help of Surge Credit Card Customer Service.

Step 1:

Go to your web browser and head over to the activation page. This webpage will take you to the activation page of your Surge credit card.

Step 2:

You will see three credentials on that webpage. Please enter the following Surge Card Info for your Surge credit card to activate:

- Last 4 Credit Card

- Last 4 SSN

- 5 Digit Zip Code

You only need to enter these three pieces of information in their respective box and Surge Credit Card Reviews.

Step 3:

After entering your Surge Credit Card credentials, hit the” Activate My Card” button. Your card is activated right away, and you are ready to enjoy the My Surge card login.

How To Make Your Surge Credit Card Payment?

If you want to pay your bills for Continental Finance Credit cards, you can make them online, over the phone, or send checks to the pay box.

Pay Online: We have explained the Surge Credit Card login steps above; please follow that and once you are on your due section, click on the play button. You will be asked for a few personal and Bank details, from which payment will be debited.

Pay Via phone: Dial 1-800-518-6142, follow the IVR and provide personal and bank details to make payment.

Pay via mail: Send payment checks to

Surge Card

PO BOX 6812

Carol Stream, IL 60197-6812

App: You can also make your Surge Credit Card Payment through the Continental Finance mobile app for iOS and Android.

Pros Of This Card

Unsecured Card Access: If you have bad credit or no credit, you may need to boost your credit with a secure card that requires a deposit. But with Surge Mastercard, you may be eligible for an unsecured credit card with a credit limit of $300 to $1,000.

Three Major Credit Bureaus: Payments to your Surge Mastercard Login account are reported every month to the three major credit reporting agencies – Experian, Equifax, and TransUnion. If you always make all your payments on time, Mastercard can help you gradually improve your credit score with Surge. Most, but not all, credit card issuers report to major credit bureaus. Before applying for a credit card for bad credit, declare your payment activity.

Standard Benefits:

The card comes with some standard benefits, including:

- $0 Liability for Unauthorized Charges

- Monthly reports to the three major credit bureaus

- Access account online

Security Features

This card offers standard security features such as limited liability for unauthorized transactions, lost or stolen card replacements, and encryption technology and submits your Surge Credit Card Reviews.

About Surge

The Surge credit card reports monthly to three major credit is reporting agency allowing customers to immediately begin restoring their credit history. It is also possible to build credit with the Surge Credit Card if you’ve never had a credit card before. Customers can view their monthly credit scores on their electronic statements through their online Surge credit card account.

The Surge credit card is designed for those with less than perfect credit, so anyone with a credit history can apply. By partnering with Celtic Bank, Continental Finance manages the Surge Mastercard. It includes financial products and services designed with users Surge Credit Card Reviews to help consumers recover credit.

Additionally, Celtic Bank offers the Surge Mastercard, offered by Continental Finance. Celtic Bank describes itself as “one of its leading small businesses and real estate lenders.”

Features Of Surge Credit Card

Below are the features and services offered by the credit card:

- It offers a quick and easy online application process

- The card is acceptable wherever MasterCard is accepted

- There is free access to the online account 24/7

- An initial credit limit of $500 applies

- The annual fee is $125 for the first year and then $96 per year

- There is no introductory APR charge

- The purchase APR rate is 29.99%

- There is a cash advance of 29.99%

- The cash advance fee is 5% of the amount of each advance in cash

Other Rates And Fees

- Cash advance APR: 24.99%-29.99% variable

- Cash advance fee: $5 or 5% of the amount of each cash advance (whichever is greater)

- Minimum interest charge: None

- Foreign transaction fee: 3% in U.S. dollars

- Late or returned payment: up to $41

- Authorized user card fee: $30

Surge Credit Card App

Download the updated version of Surge’s credit card app from the company’s website. A link is available for both the Android and iOS apps on the homepage and Surge Card Login page. You can click on the app link, and you will be redirected to your app store or google play store, where you can download the app.

Surge Credit Card App Benefits

Below are some of the benefits you can access while using the mobile app:

- You can check the account’s current balance and available credit, make a one-time payment, manage autopay, manage scheduled payments, and check recent activities from the home screen.

- You can check recent activities/transactions on the app and download e-statements through the Activity & Statements option.

- There are different useful services in the Payment options like Manage Autopay, Disable Autopay, One-time payment, scheduled payment, etc with this Surge Credit Card App.

- You can manage and update account information like contact details, address, and more with Surge Credit Card Customer Service.

Customer Service Support For Surge Credit Card

Surge credit card is the product of Continental Finance, LLC. Therefore, customer support is provided 24/7by Continental Finance LLC for its users. Any concern regarding the Surge CC login is resolved through the customer service helpline.

Not just concern, the information request and application process are also provided on the customer support platform. Please call 1-800-556-5678 to speak to the customer support team of the Surge credit card.

Frequently Asked Questions

What information is required when I apply for a Surge credit card?

You’ll need to provide personal information, including your:

- Full name

- Social Security number

- Date of birth

- Physical address (No P.O. Box)

- Estimated gross monthly income

Can the Surge Credit Card increase credit lines?

Consumers who are eligible for a Surge Mastercard do have their credit limits increased. They begin with credit lines between $300 and $1,000 and can increase after six months.

How can I manage my new My Surge Card Info account online?

Yes. You will be able to access our Online Banking Service to perform all of the following actions with your Surge Card:

- Make a Surge credit card payment

- Enroll to receive online statements for your My Surge Card Info

- View recent transactions

- View previous statements

- View payment history

- View your balance and other important Surge credit info

To do so, you need to sign up and get your Surge login information. Then you can access your Surge Card Login info anytime, with the help of Surge Credit Card Customer Service

Last Note

People with any credit score can apply for the Surge credit card because it is designed for people with less-than-perfect credit. Surge Mastercards are issued by Celtic Bank and facilitated by Continental Finance. Several financial products and services are available to consumers to help them gain control over their credit.

A Surge Mastercard with an initial credit limit ranges from $300 to $1,000. Use your My Surge Card Info at locations everywhere Mastercard is accepted. With your new Surge credit card, shopping, dining, and even travel are all in your future. If you keep your balance under your credit limit and make your payments on time, your Surge credit card account can help you rebuild or improve your credit score.